Yes, NOTICENINJA is corporate tax notice compliance software that automates key workflows including notice assignments. The platform employs a rule-based system that can manage multiple level rules and ensure notices are directed to the appropriate stakeholder. As a result, you’ll never have to worry about notices being misdirected or slipping between the cracks.

.png)

A Guide to Resolving Corporate Tax Notices

02 October

Navigating the complex world of business taxes can be a daunting task. One crucial aspect of this journey is understanding and effectively responding to tax notices. Whether you're a small startup or a large corporation, receiving a tax notice can be a stressful experience. However, with the right knowledge and a clear plan of action, you can confidently address these notices and ensure your business remains compliant with tax regulations. In this comprehensive guide, we will walk you through everything you need to know about business tax notices, from the types you might encounter to the best practices for handling them.

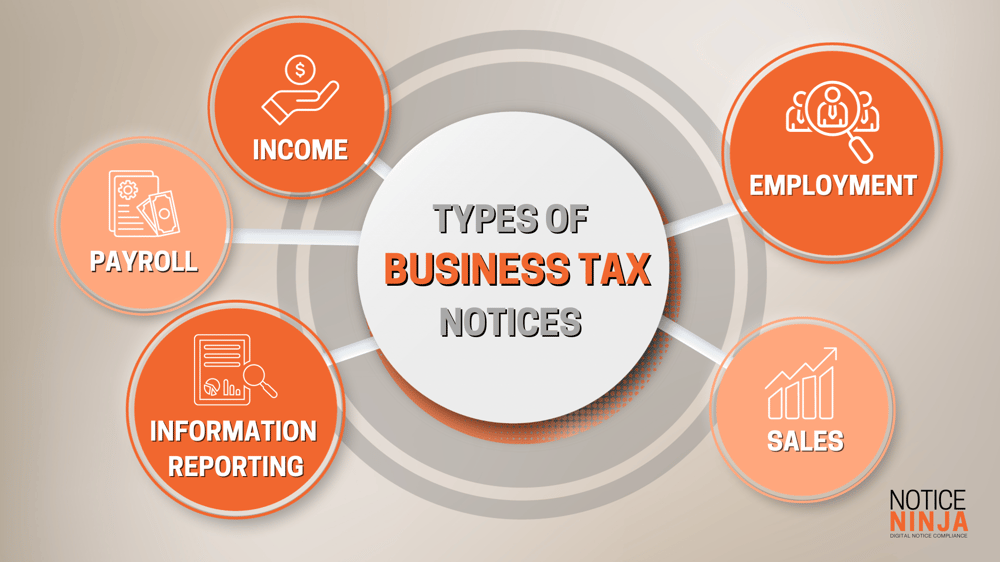

- Types of Business Tax Notices:

Business tax notices come in various forms, each serving a specific purpose. Some common types include:

- Income Tax Notices: These may include notifications of changes to your tax return, requests for additional information, or audits of your financial records.

- Payroll Tax Notices: Pertaining to employee wage withholding, Social Security, and Medicare taxes. Non-compliance can result in severe penalties.

- Sales Tax Notices: Often issued by state tax authorities, these notices address sales tax collection, remittance, or discrepancies.

- Employment Tax Notices: These pertain to federal employment taxes and cover issues like misclassification of employees and tax deposit requirements.

- Information Reporting Notices: Related to forms such as 1099s and W-2s, these notices address discrepancies or missing information in your filings.

- Understanding the Contents:

It's crucial to read and understand the contents of the tax notice thoroughly. Pay attention to the reason for the notice, the specific tax issue it addresses, and the deadline for responding. Ignoring or misinterpreting these details can lead to costly consequences.

- Immediate Steps to Take:

When you receive a tax notice, take these initial steps:

- Create an organizational plan

- Record the notice's date of receipt.

- Verify the notice's legitimacy by confirming it comes from the appropriate tax authority.

- Review your records to ensure the accuracy of the notice's claims.

- Contact your tax advisor or attorney for professional guidance.

- Responding to the Notice:

Depending on the nature of the notice, your response may involve:

- Providing requested information or documentation

- Paying any outstanding taxes, fines, or penalties.

- Filing an appeal or requesting an extension if necessary.

- Seeking professional assistance to navigate complex issues.

- Avoiding Future Notices:

To minimize the chances of receiving tax notices in the future, consider implementing these best practices:

- Maintain meticulous records of your financial transactions and tax filings.

- Stay informed about tax law changes and compliance requirements.

- Regularly review and reconcile your financial statements and tax returns.

- Consider using tax management software or professional services to streamline your tax notice processes.

Receiving a business tax notice can be unsettling, but it doesn't have to be overwhelming. By understanding the types of notices you may encounter, promptly responding with accurate information, and adopting proactive tax management practices, you can navigate the world of business tax notices with confidence. Remember, staying informed and seeking professional guidance when needed are key steps in maintaining tax compliance and safeguarding your business's financial health.

Register for our upcoming Webinar: Unlocking Success in 2024: Key Tax Updates with KPMG Tax Managing Partner Mindy Mayo and Notice Ninja CPO | Cofounder Rick Pinkerman on Tuesday November 14, 2023.