Yes, NOTICENINJA is corporate tax notice compliance software that automates key workflows including notice assignments. The platform employs a rule-based system that can manage multiple level rules and ensure notices are directed to the appropriate stakeholder. As a result, you’ll never have to worry about notices being misdirected or slipping between the cracks.

Optimize Your Work Opportunity Tax Credit

07 March

Rick Pinkerman, founder and CEO of NOTICENINJA, was joined by Brian Kelly and Patrick Morrissey of Cost Management Services to discuss Work Opportunity Tax Credit (WOTC) and how to standardize your notice compliance system.

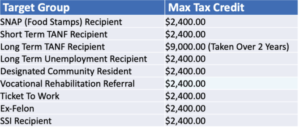

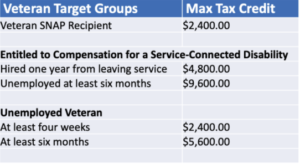

Work Opportunity Tax Credit (WOTC) is a federal tax credit available to employers, rewarding them for every new hire who meets eligibility requirements. In 2019, employers claimed $4.9 billion in tax credits, and it was renewed through 12/31/2025. The eligible employees include:

WOTC is calculated through two benchmarks: (1) The employee needs to work at least 120 hours for the employer to receive 25% of the first $6,000 in gross wages and (2) The employee needs to work at least 400 hours for the employer to receive 40% of the first $6,000 in gross wages. In general, 10-15% of new hires qualify.

Brian Kelly explained that Cost Management Services (CMS) screens hires for eligibility, as they submit information to the State Workforce Agency and calculate the value of WOTC credits. Users can track the value of their tax credits in real time via the secure admin portal. Overall, CMS does all the administration and processing work, and users get the benefit of receiving tax credits.

Like CMS, NOTICENINJA offers a standardized system with advanced options and features to do the administrative work for clients. With NOTICENINJA, clients automate and streamline processes to quickly and efficiently capture, track, manage and resolve tax and compliance notices, minimizing the risk of missed or delayed responses resulting in increased penalties, fees, fines, and lost revenue. To learn more about NOTICENINJA, visit https://www.noticeninja.com and to learn more about Cost Management Services, visit https://www.cmshris.com.

To view the webinar with NOTICENINJA and Cost Management Services click here.

If you need help with IRS notices, tax compliance, or notice tracking, we're here for you. Contact us through our website or by clicking the "Schedule a Meeting" button in the header, and we'll be happy to assist you. Our experts can help you navigate the complex world of tax notices and audits, ensuring that your organization stays in compliance and avoids penalties. Let us help you take the stress out of tax notices – contact us today!