Tax Compliance Hotspots: The States Driving the Most Tax Notices

04 February

For tax teams, the final quarter of the year often feels like a battle—unexpected notices, shifting regulations, and the pressure to close out the year cleanly. From October 1 to December 31, 2024, our NOTICENINJA data revealed tax notice volume by state for our clients.

This isn’t a theoretical model—it’s a real-world reflection of where tax teams using our platform encountered the most compliance challenges. The states with the highest notice volume—New Jersey, Massachusetts, Tennessee, and Michigan—weren’t just outliers; they were proving grounds, exposing the most difficult compliance landscapes businesses had to navigate.

But raw numbers don’t tell the full story. The bigger question is: Why? What is happening in these states that makes compliance so challenging? And what can tax teams do in Q1 to stay ahead of the notices?

Where Are the Most Notices Coming From?

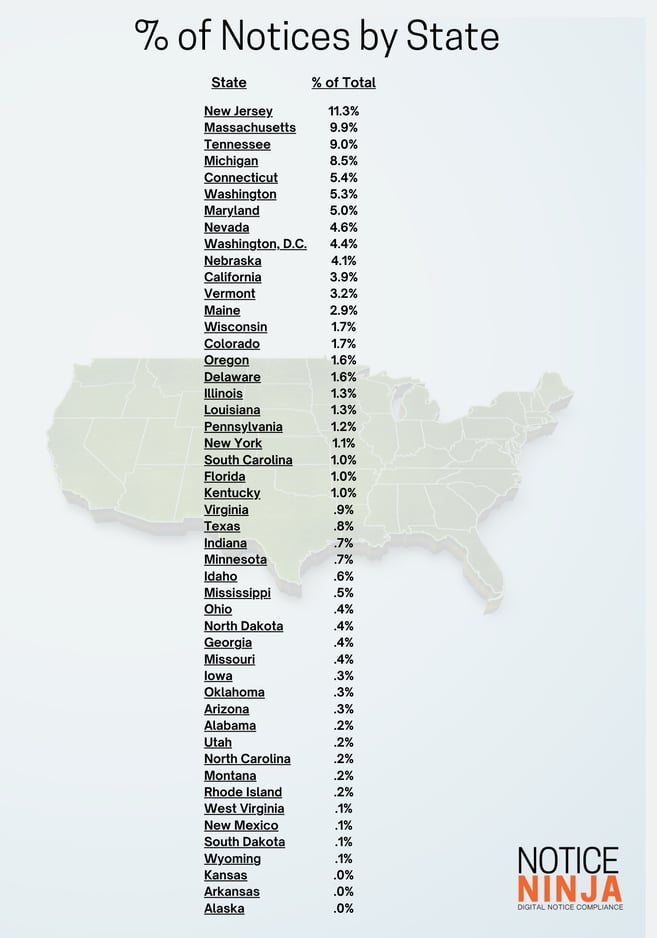

To provide a clearer picture of tax compliance trends, we analyzed tax notice volume as a percentage of total notices recorded in Q4 2024 across all states.

% of Notices by State

This data highlights the most challenging states for tax compliance based on notices our clients received. But the real value lies in understanding why these states create compliance issues—so tax teams can take smarter action moving forward.

Why Are These States Seeing the Most Tax Notices?

Each of these states presents unique compliance challenges, from strict enforcement and aggressive auditing to complex tax structures and high business activity.

- New Jersey (11.3%) – A Compliance Gauntlet

New Jersey’s top ranking isn’t a surprise—it’s one of the most aggressive tax enforcement states in the country. For companies operating across multiple jurisdictions, New Jersey’s state and local tax (SALT) system creates endless compliance hurdles.

🚨 What’s driving notices?

- Multi-state employment tax issues—with so many businesses operating across New Jersey, New York, and Pennsylvania, payroll compliance is a constant challenge.

- Strict enforcement of sales & use tax regulations, especially for companies selling online or across state lines.

- High volume of withholding tax audits, making compliance a moving target for payroll teams.

- Massachusetts (9.9%) – The Audit Hotspot

Massachusetts isn't just steeped in history—it’s also known for frequent audits and strict tax policies. Its Department of Revenue takes an aggressive approach to employer tax filings, making compliance a constant struggle.

🚨 What’s driving notices?

- Payroll tax compliance is highly scrutinized, leading to frequent employer notices.

- Sales tax enforcement is strong, especially for businesses in e-commerce, SaaS, and digital goods.

- High business density means high audit activity—tax authorities actively review returns for compliance errors.

- Tennessee (9.0%) – The Tax Structure Outlier

Tennessee doesn’t have a broad-based income tax, but that doesn’t mean compliance is easy. Instead, the state relies on strict business taxes like the Franchise & Excise Tax, catching companies off guard with complex reporting requirements.

🚨 What’s driving notices?

- The Franchise & Excise Tax is often miscalculated, leading to notices for underpayment or incorrect filings.

- Sales tax compliance is strictly enforced, making accurate reporting essential for retailers and service providers.

- Businesses unfamiliar with Tennessee’s tax structure often make errors that lead to state notices.

- Michigan (8.5%) – The Payroll Compliance Challenge

Michigan’s high notice volume is largely tied to payroll tax complexity. Companies operating in the state must comply with multiple city-level payroll tax rules, making withholding compliance particularly difficult.

🚨 What’s driving notices?

- Multi-city payroll tax obligations, requiring businesses to track and remit payments across jurisdictions.

- Frequent reconciliation notices, where discrepancies in employer tax filings lead to state-issued adjustments.

- Withholding tax issues, especially for businesses managing remote or hybrid workers.

Why Are Tax Notices Spiking in Q4?

Beyond state-specific challenges, Q4 itself introduces unique compliance risks. Three key factors drive an increase in tax notices during the final months of the year:

✔ Year-End Reconciliations: As businesses close their books, unresolved tax issues from earlier in the year surface, leading to increased notice volume.

✔ Regulatory Changes: January 1 often marks the introduction of new tax rules, forcing teams to scramble to adapt while still resolving Q4 issues.

✔ Seasonal Activity: In retail-heavy states like New Jersey and Massachusetts, the holiday season means higher transaction volume, increasing the likelihood of reporting discrepancies.

From Data to Action: What Tax Teams Can Do in Q1

The best way to reduce tax notices isn’t to react faster—it’s to prevent them in the first place. By studying Q4 trends, tax teams can refine workflows, close compliance gaps, and take control in Q1.

Strategic Playbook: How to Stay Ahead in Q1

Blend Into the Compliance Landscape

Great tax teams don’t fight compliance—they work with it, integrating best practices into their daily operations. When compliance becomes second nature, tax notices drop.

🛠 Action: Use a centralized compliance platform to track state-specific tax requirements, ensuring no obligations slip through the cracks.

Observe Patterns and Stay Proactive

A ninja’s greatest skill wasn’t strength—it was awareness. Tax teams must study their notice patterns to catch problems before they escalate.

🛠 Action: Analyze Q4 notice trends—which states issued the most penalties? What filing errors repeated? Use this data to adjust internal processes.

Move with Agility and Precision

Fast, efficient responses keep compliance teams ahead of notices. Is your tax team reacting to notices—or preventing them?

🛠 Action: Automate deadline tracking and reconciliation to minimize human error and eliminate slow, manual processes.

Master the Right Tools for the Job

A ninja doesn’t carry extra weapons—just the right ones. The right tax compliance technology eliminates inefficiencies.

🛠 Action: Invest in workflow automation and AI-powered notice tracking to ensure teams don’t waste time chasing paperwork.

Refuse to Settle for the Status Quo

If Q4 was a compliance struggle, doing the same thing in Q1 won’t fix it. Tax teams must continuously improve, refine, and stay ahead.

🛠 Action: Host internal training, refine tax workflows, and implement automation to turn reactive compliance into proactive strategy.

Take Control of Q1

The story of Q4 doesn’t have to repeat in Q1. By analyzing trends, adapting strategies, and leveraging automation, tax teams can stay ahead of compliance challenges—without losing their footing (or their sword).

To genuinely progress, consider this: Are you ready to reduce tax notices and streamline compliance? Speak to a Notice Ninja expert today and take charge of Q1.

RELATED POSTS

- The Most Common Tax Notices You'll Receive

- A Guide to Business Tax Notices

- Challenges of Organizing Tax Notices on Excel

.png)