Yes, NOTICENINJA is corporate tax notice compliance software that automates key workflows including notice assignments. The platform employs a rule-based system that can manage multiple level rules and ensure notices are directed to the appropriate stakeholder. As a result, you’ll never have to worry about notices being misdirected or slipping between the cracks.

Where Can I Find the Notice Number for My Taxes?

07 June

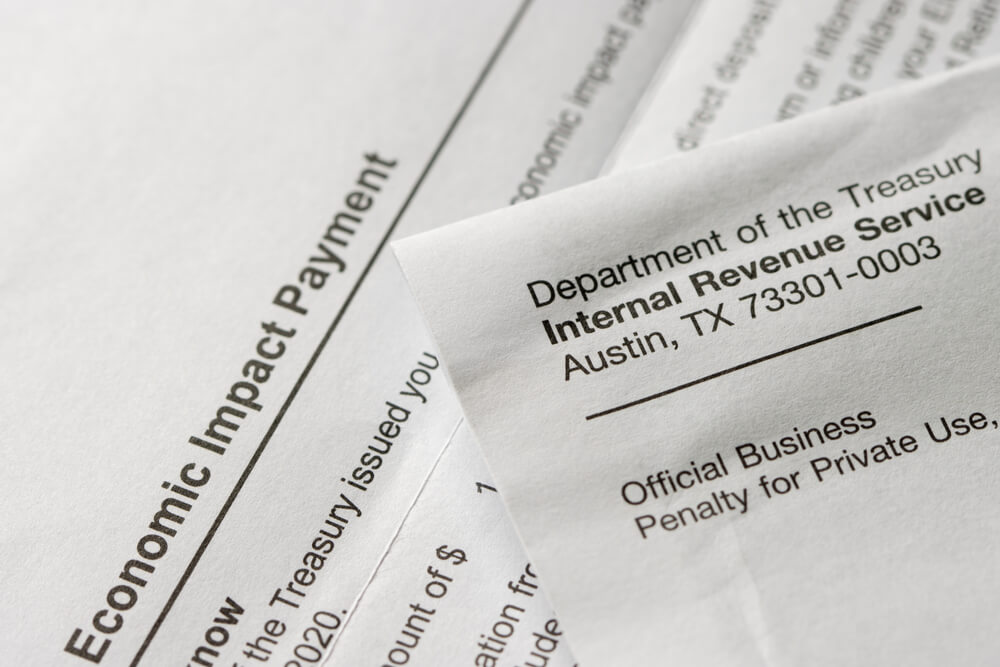

When you receive a notice or letter from the Internal Revenue Service or IRS, you must not delay opening it. The IRS will send tax notices for the following reasons:

- They need additional information

- They changed your return

- They're notifying you of delays in processing your return

- They need to verify your identity

- They have a specific question regarding your tax return

- You have a balance due

- You are due a larger or smaller refund

While not all notices require a response, the sooner you read them, the sooner you can interpret if any action is required. All the necessary information you need to proceed will be clearly stated on your IRS tax notice. You will be able to handle most of this correspondence by following the instructions on the letter.

Where is the Notice Number?

Whether you've received one or multiple tax notices, keeping track of the notice number will help you organize your documents and prevent accidental failure to comply or respond. Moreover, the number on your IRS notice indicates the reason for the correspondence and directs you to the next steps required.

You'll find the number on either the top or bottom right-hand corner of your tax notice. The number will either begin with 'CP,' indicating that it's a notice, or 'LTR,' indicating that it's a letter.

This notice number can be used to help you verify information, look up notices online, and help you maintain organization.

What If My Notice Has No Number?

If your IRS tax notice doesn't have a number, or you believe the correspondence looks suspicious, contact a tax professional for help. A tax professional will help you determine if the notice or letter is fraudulent. It's crucial to keep a copy of all notices, even if found to be fraudulent, with your records because you may need these documents in the future.

Stay Informed by Understanding Your Tax Notice

Keeping your IRS tax notices organized will help ensure that you are compliant. Responding to a few tax letters is manageable, but when handling more than you can count, Notice Ninja can help. Move past outdated spreadsheets and data entry by learning about our easy automated program! Fill out the form below today and to speak a tax notice expert.